The Psychology of Cryptocurrency HODLing: Reasons, Risks, and Rewards

The Psychology of Cryptocurrency HODLing: Reasons, Risks, and Rewards

Understanding HODLing: What is it and why do people do it?

Reasons for HODLing

Cryptocurrencies have taken the world by storm, and one popular strategy among investors is called HODLing. The term “HODL” initially emerged as a misspelling of “hold” in a Bitcoin forum. It has since become a widely-used term to describe the act of holding onto cryptocurrency for the long term, regardless of market fluctuations. But why do people engage in HODLing?

1. Potential for Long-Term Gains: HODLers believe that cryptocurrencies have the potential to deliver substantial returns over time. By holding onto their coins, they aim to ride out market volatility and benefit from future price appreciation.

2. Emotional Attachment: The psychological aspect of HODLing is significant. Investors become emotionally attached to their chosen cryptocurrencies, developing a sense of ownership and loyalty. They believe in the technology and the future potential of the coins they hold, which drives their decision to HODL.

Risks of HODLing

While HODLing can be rewarding, it also comes with its fair share of risks:

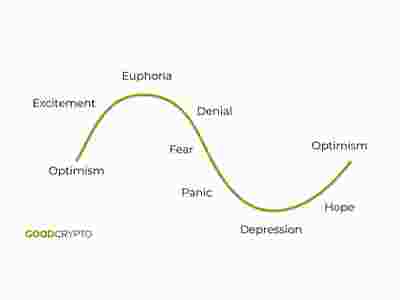

1. Volatility: Cryptocurrency markets are highly volatile, with prices capable of experiencing massive fluctuations within short periods. HODLing means bearing the brunt of these fluctuations, which could result in significant losses if the market takes a downturn.

2. Opportunity Cost: By HODLing, investors often miss out on potential short-term gains by failing to capitalize on market trends. Timing the market is a challenging task, and while HODLing may ensure long-term gains, it may also mean passing up lucrative opportunities in the short run.

Rewards of HODLing

Despite the risks involved, HODLing can also offer substantial rewards:

1. Long-Term Growth: Cryptocurrency markets have historically shown a tendency to rebound and offer substantial long-term growth. By staying committed to HODLing, investors have the potential to benefit from these upswings and accumulate significant wealth over time.

2. Psychological Benefit: HODLing allows investors to avoid the stress of constant monitoring and trading their cryptocurrencies. By maintaining a long-term perspective, HODLers often experience greater peace of mind and reduced decision-making pressure.

Frequently Asked Questions (FAQs)

Q: Is HODLing suitable for all types of cryptocurrencies?

A: HODLing is typically associated with well-established cryptocurrencies like Bitcoin and Ethereum. While it can be applied to other coins, investors should conduct thorough research and consider factors, such as market stability and future potential, before deciding to HODL.

Q: How long should one hold onto their cryptocurrencies?

A: The duration of HODLing varies among investors. Some HODLers have a long-term perspective, intending to hold indefinitely, while others have specific targets or milestones for selling their holdings. Each investor should determine their own strategy based on their investment goals.

Q: Should I HODL during market downturns?

A: Market downturns can be an excellent opportunity to buy cryptocurrencies at discounted prices. However, HODLing during these periods depends on your risk tolerance and belief in the long-term potential of your chosen coins. Consider consulting a financial advisor for guidance during market fluctuations.

In Conclusion

HODLing is a popular approach in the world of cryptocurrency investment. It appeals to individuals who have faith in the future of cryptocurrencies and are willing to weather the market’s volatility. While it comes with risks, such as missing out on short-term gains and enduring market downturns, HODLing can potentially lead to significant long-term rewards. As always, it is essential to conduct thorough research, understand the market, and make informed decisions that align with your investment goals and risk tolerance.